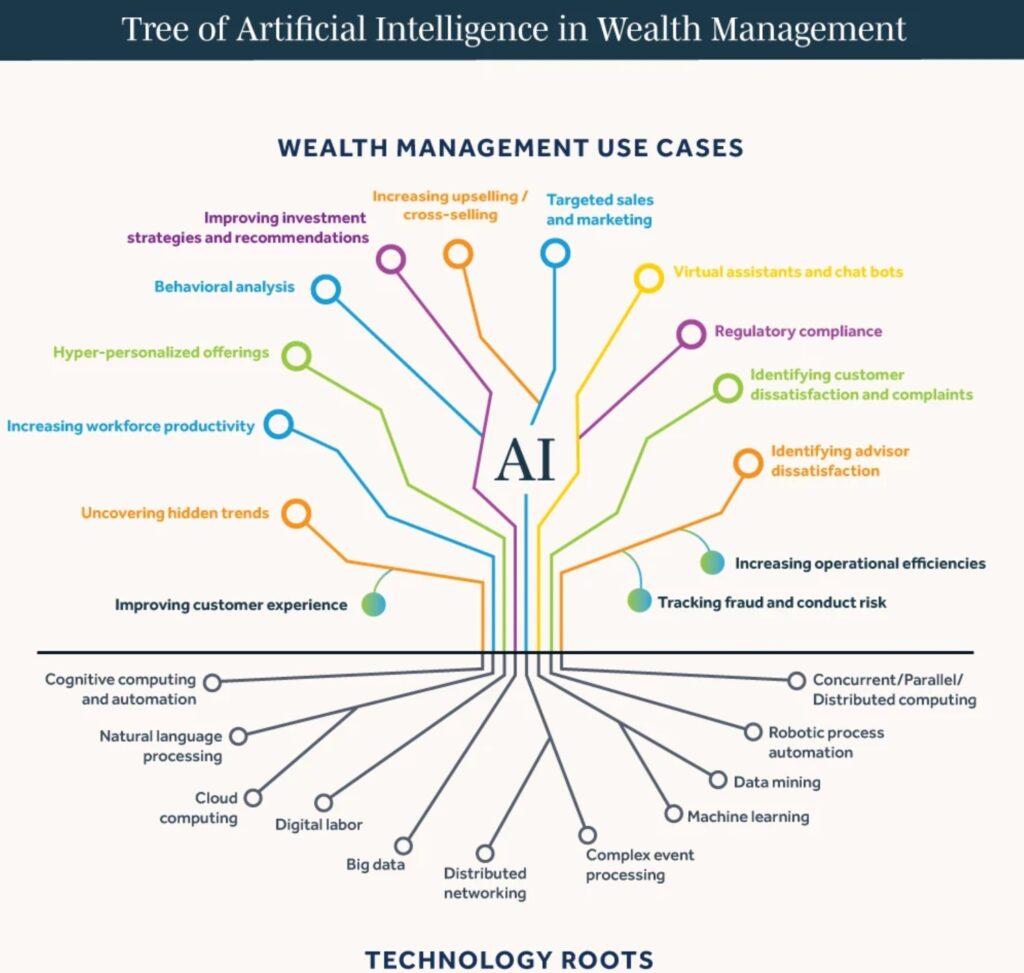

What is Artificial Intelligence?

A recent Financial Conduct Authority (FCA) discussion paper, DP22/4: Artificial Intelligence, offered the following definition of Artificial Intelligence (AI):

‘It is generally accepted that AI is the simulation of human intelligence by machines, including the use of computer systems, which have the ability to perform tasks that demonstrate learning, decision-making, problem solving, and other tasks which previously required human intelligence. Machine learning is a sub-branch of AI.

AI, a branch of computer science, is complex and evolving in terms of its precise definition. It is broadly seen as part of a spectrum of computational and mathematical methodologies that include innovative data analytics and data modelling techniques.’

- WHAT DO FIRMS NEED TO CONSIDER?

Many PIMFA members are already using AI systems and tools in their everyday operations, and it is likely that the adoption of AI in financial services will increase rapidly over the next few years.

PIMFA firms already use AI tools for several purposes. For example, they analyse large volumes of data quickly, easily, and accurately, which enables their employees to spend more time working with and for their clients.

There are concerns that as AI becomes more advanced, it could introduce new risks, for example:

system develops biases in its decision making

leading firms to make bad decisions

rESULTING IN Poor outcomes for their clients

This is why it is essential that firms deploying AI systems have a suitably robust control framework around their AI components to keep a careful check on what they are doing.

As with any innovation, AI has the potential to make fundamental and far ranging improvements in how firms can serve their clients. However, we must ensure it is continually monitored and checked regularly to manage the risk and maximise the benefit.

- What are regulators doing?

A number of government departments are asking regulators such as the Financial Conduct Authority (FCA), Bank of England (BoE), Information Commissioners Office (ICO) and Competition and Markets Authority (CMA) to publish an update on their strategic approach to AI and the steps they are taking according to the White Paper. The Secretary of State is asking for this update by 30 April 2024.

On 13 March 2024, the EU Parliament approved the EU Artificial Intelligence Act. The EU AI Act sets out a comprehensive legal framework governing AI, establishing EU-wide rules on data quality, transparency, human oversight and accountability. It features some challenging requirements, has a broad extraterritorial effect and potentially huge fines for non-compliance.

latest news

ICO tech futures: Agentic AI

The UK Information Commissioner’s Office has published new guidance on agentic AI systems – autonomous AI agents that can perceive their environment, make decisions, and take actions with minimal human oversight. The ICO’s Tech Futures report examines the data protection implications of these increasingly sophisticated systems, which are capable of planning multi-step tasks, using tools, and adapting their behaviour based on feedback. The guidance highlights key risks including unpredictable outputs, opacity in decision-making processes, and challenges in establishing accountability when AI agents operate autonomously.

Organisations deploying agentic AI are advised to implement robust governance frameworks, maintain human oversight at critical decision points, and ensure transparency about when customers are interacting with autonomous agents rather than humans. As these systems become more prevalent the ICO emphasises that existing data protection principles still apply, meaning organisations remain accountable for their AI agents’ actions and must be able to explain automated decisions that significantly affect individuals.

The full report can be accessed here

AI is already reshaping compliance. The objective is not to constrain innovation but to enable it responsibly.

To learn more read our full opinion piece on FT Adviser

FCA launches AI Live Testing initiative

FCA is partnering with major firms to safely test AI in UK financial markets. The programme provides tailored regulatory support to ensure AI is deployed responsibly, with early participants including NatWest, Monzo, Santander, and Scottish Widows. Applications for the next cohort open in January 2026.

Read more here.

New PIMFA guest blog:

Strategy and data as the foundation for AI success in Wealth and Asset Management

In this guest blog Edward Russell, Principal Consultant at Solve Partners, highlights that now firms are discovering that AI amplifies what they already have, strong foundations will enable competitive advantages, whereas weak foundations may accelerate existing problems.

Read the full blog here.

Financial Services Skills Commission call for evidence: The impact of AI and disruptive technology

The Financial Services Skills Commission (FSSC) has published a call for evidence (CfE) on how AI and disruptive technology will change financial services, as well as its workforce, over the next five to ten years.

The FSSC will analyse and recommend how skills can drive growth and productivity by supporting the adoption and innovation of AI in financial services.

The CfE closes on 26 November 2025 and the research phase of this project will include publication of an interim report in 2026.

The AI Advantage: How to Revolutionise Business Growth with Reverification

Read here an article from the PIMFA Journal #32 by Alexander Blayney, Global Partnerships & Enterprise Sales at Id-pal, looking at how, with the increasing prevalence of identity fraud, AI can help revolutionise business growth when applied to identity reverification

PIMFA Compliance Conference 2025

Kevin Sloane, Senior Policy Advisor, PIMFA with his panel members Marina Reason, Partner, Financial Services Regulation, Herbert Smith Freehills Kramer LLP,Becky Thompson, Manager, Continuous Improvement, Redmayne Bentley and Richard Preece, Director, DA Resilience. Speaking about Leveraging Artificial Intelligence to meet your compliance challenges at the 2025 PIMFA Compliance Conference

PIMFA

PIMFA